|

MacDonald Mines

Exploration Ltd.

Mining,

Precious Metals, Industrial

TSX-V: BMK, OTC: MCDMF,

Franfurt: 3M72,

http://www.macdonaldmines.com |

|

Prices |

Share:

C$0.23 |

MCap: ~C$13.8M |

On: 03/31/2017 |

|

History |

52-Week:

C$0.005–C$0.27 |

|

|

|

Prices |

Shares O/S:

59,638,874 |

|

|

|

|

|

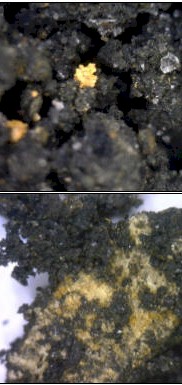

Fig. 2 (below) Oxide Sands Wawa-Holdsworth Property

|

Investment Thesis

-- Near-term (12 month) TSX-V:BMK share price target; C$1.50

MacDonald Mines Exploration Ltd.

(TSX-V:

BMK) (US Listing: MCDMF) (Frankfurt: 3M72) this week

announced 100% LOI ownership of the Wawa-Holdsworth Gold Project with terms that point to

an imminent production scenario; aside from

5.5 million shares of BMK.V issued (along with equal warrants

exercisable at $0.30 -- something we like to see as the belief is

share price of BMK.V will rise substantially) and a partially

repurchasable 1.5%NSR, the bulk of the principle consists of

MacDonald Mines paying the equivalent of 5,000 ounces of gold

equivalent to Noble once MacDonald has extracted, refined and sold a

minimum of 50,000 ounces of gold from the oxide sands portion of the

Property.

In brief, the oxide sands are the cap of the pyrite prospect on the

property, which to date is just over 2,200 metres long and has a defined

historic (non NI 43-101) resource of sulpher but never tested for Gold until 1988 (it was

noted to have gold in it from trace to over 8 g/t, however no

assaying was done for silver at the time). 43-101 compliant drilling in 2002

covered 332 m of strike length (of the 2,200 m); within that known

length and extrapolated for tested widths + estimated depth we get

sizeable tonnage of apparent ~3.45 g/t Gold (average grade tested)

and ~29.99 g/t Silver (average grade tested) ready for the taking.

Extrapolating that known 332 m length (x ~6) over the 2,200 m there

appears 146,000 tonnes of such material for the taking in the

initial strike set. The average depth based on historic drill holes

would be much larger as far as

surface extraction goes. The assumption on a parallel and multiple

sets of sulphide sands is valid and has been proven in drill holes

-- this rationalizes 550,000 to 675,000 tonnes (not yet NI 43-101, but

the science is there to more than support an ~81,700+ ounce Gold

equivalent target), most of

which can be self financed from production that appears to require

little capex at all to begin. Neither aggregate licencing nor bulk

sampling permissions will be required for the extraction of the

oxide sands on the Wawa-Holdsworth Project.

Market Equities Research Group projects

(non NI 43-101) along the initial strike set of sulphide sands

alone:

|

Gold Oz |

Silver Oz |

|

146,000t |

146,000t |

|

@3.355

g/t |

@29.2

g/t |

|

15,750

oz |

137,000 oz |

| Can$1,500.00/oz |

Can$20.00/oz |

|

Can$23,625,000 |

Can$2,740,000 |

Table 1. Guesstimate of gold in initial strike set of sulphide sands alone.

and >four times that (totaling

675,000 tonnes = ~72,800 oz Gold, ~633,700 oz Silver *non NI

43-101 = ~81,700 oz Gold Equivalent (using US$17/oz Silver and

US$1,200/oz Gold conversion) on parallel and multiple

sets which have been proven in drill holes. Note: Values derived are

based on past exploration results of Reed Lake Exploration (pre dating

NI 43-101) and Hawk/Nobel's exploration results (NI 43-101 compliant)

which affirm 550,000+ tonnes.

|

Gold Oz |

Silver Oz |

|

675 ,000t |

675 ,000t |

|

@3.355

g/t |

@29.2

g/t |

|

72,800

oz |

633,700

oz |

| Can$1,500.00/oz |

Can$20.00/oz |

|

Can$109,200,000 |

Can$12,674,000 |

Table 2.

Guesstimate of gold from initial strike set and parallel/multiple sets.

Fig. 3 (above) Exposed gold laden black

oxide sands.

Oxide Sands can be treated like aggregate.

Visible in the images of black oxide sands

(seen in Fig. 2 above) taken from the property is gold and some course

grain quartz (which likely also contain gold). The oxide sand zones

appear amenable to MacDonald Mines simply obtaining a permit for

mining aggregate; backhoe the material, then crush and ball mill the

material (to maximize recoveries), and transport the floured

material to one of the

several mills located within a few kilometers of the property.

Works programs underway this spring 2017 are geared towards

affirming a voluminous and robust understanding of these Oxide Sands

Zones -- the potential for substantial

share price appreciation closer to $1.50/share from current price levels appears in order

as exploration findings/results affirm what is suspected.

Figure 4. Wawa-Holdsworth Gold Zones -Three styles of gold

mineralization exist on the original 285 hectares Wawa-Holdsworth

project (the Company has since added 84 claims of similar ground

nearby), all part of the same gold system within the 500 metre-wide

deformation corridor.

The three gold mineralization styles on the

property (and shown in the claims map above) are:

-

An oxidized cap at surface

developed over a massive pyrite zone (Algoma Iron

Formation) -- "The Oxide Sands",

-

The precursor to the Oxide

Sands - a massive pyrite zone (Algoma Iron

Formation) at depths -- "The Massive Sulphide", and

-

Lode Gold in traditional quartz

veins -- "The Soocana Vein"; noteworthy

historic (non NI 43-101 compliant) drilling

intersections include 16g/t gold over 4.3 m, and 6.9

g/t gold over 15.8m and demonstrates the potential.

In 1933 the Soocana Mining Company Limited

calculated a gold resource (historical non NI43-101)

of 54,000 tons of material grading 0.556 oz/t (19.06

g/t) -- this is historic resource was never mined!

Sample of exploration results in support of Company's 50,000 oz

Gold target on Oxide Sands:

In 2002, the Oxide Sands were sampled over 332.5 metres along

strike. They were reported to reach a depth of at least 8 metres and

contained an average gold grade of 3.45 g/t and an average silver

grade of 29.99 g/t. Preliminary metallurgical testing resulted in

between 69% and 98.7% gold recoveries, without even crushing.

Results from the 2002 Sampling

Program:

|

BLOCK

Block # |

A

(m) LENGTH |

(m)AVERAGEWIDTH |

(m) AVERAGE DEPTH |

SPECIFIC GRAVITY |

INDICATED TONNES |

GOLD GRADE

(gms/tonne) |

SILVER GRADE

(gms/tonne) |

|

A-1 |

30.0 |

6.9 |

4.65 |

2.5 |

2392 |

4.92 |

25.22 |

|

A-2 |

13.5 |

5.3 |

3.00 |

2.5 |

540 |

5.76 |

42.65 |

|

A-3 |

31.0 |

4.7 |

3.35 |

2.5 |

1228 |

5.95 |

47.09 |

|

A-4 |

10.0 |

3.5 |

3.74 |

2.5 |

328 |

5.94 |

50.78 |

|

A-5 |

24.0 |

2.9 |

3.66 |

2.5 |

630 |

5.10 |

50.14 |

|

A-6 |

8.0 |

5.3 |

5.49 |

2.5 |

583 |

2.99 |

36.01 |

|

A-7 |

11.5 |

7.5 |

5.03 |

2.5 |

1080 |

1.74 |

21.29 |

|

A-8 |

20.0 |

6.3 |

3.65 |

2.5 |

1140 |

0.85 |

9.91 |

|

Sub-total |

148m |

5.3 |

4.07 |

2.5 |

7921 |

4.03 |

30.89 |

|

BLOCK |

B |

|

|

|

|

|

|

|

B-1 |

21.0 |

6.4 |

1.92 |

2.5 |

645 |

1.17 |

17.43 |

|

B-2 |

53.0 |

3.8 |

1.14 |

2.5 |

576 |

1.20 |

17.94 |

|

B-3 |

17.5 |

2.8 |

1.60 |

2.5 |

193 |

3.04 |

44.06 |

|

B-4 |

17.5 |

5.5 |

3.20 |

2.5 |

769 |

3.88 |

50.56 |

|

B-5 |

10.0 |

5.5 |

3.20 |

2.5 |

439 |

3.51 |

41.28 |

|

B-6 |

45.5 |

3.6 |

2.28 |

2.5 |

944 |

1.84 |

16.83 |

|

B-7 |

20.0 |

3.0 |

1.83 |

2.5 |

275 |

1.54 |

18.6 |

|

Sb-total |

184.5 |

3.8 |

1.87 |

2.5 |

3839 |

2.27 |

28.14 |

|

TOTAL |

332.5 |

4.55 |

2.97 |

2.5 |

11760 |

3.45 |

29.99 |

|

|

|

|

|

|

|

|

|

Table 2.

Drill Results within one section of Oxide Sands sound within Pyrite

Prospect.

Historic (non NI 43-101) sulphide

resource:

The Holdsworth Pyrite Prospect consists of

massive lenses of pyrite situated at the contact between mafic and

felsic metavolcanic rocks. These lenses trend approximately east-west

and dip steeply towards the north. They are locally cut and offset by

north-northwest trending faults. At present, five related zones have

been confirmed by surface stripping and prospecting and several others

indicated by ground geophysical surveys. The five confirmed zones (the

'East', 'East Extension', 'East Offset', 'West' and 'West Offset') have

a combined strike length in excess of 2200 meters. Two drill programs

completed from 1918 to 1926 (Algoma Steel Corp. and the Grasseli

Chemical Co.) identified an iron reserve of 1,019,273 tons of 46 %

sulphides within what is herein referred to as the East Pyrite Zone.

The oxidized material that forms a "cap" to the Holdsworth Pyrite

deposit has been described by old-time prospectors as a 'black sand'. It

consists of siliceous grains and non magnetic iron oxide pellets ranging

from a few centimeters to several microns in size. It is assumed to be

the oxidized equivalent of the underlying massive iron sulphide. The

underlying sulphides typically contain up to 5% sugary to greasy quartz

stringers and ribbons which are found locally within the black sand. The

sulphide zones are frequently anomalous in gold. Assays from a number of

drill holes (Band, 1983; Sears, 1989) have ranged from nil to 0.056

oz/ton, Au. The best intersection to date was from Hole R26 (Reed Lake

Exploration, 1988) which contained a 6.1 meter (20 foot) section

assaying 1.06 g/t (0.031) oz/ton, Au. The enriched gold values in the

overlying material are assumed to be related to the oxidizing and

weathering process.

Location details:

Figure 4. Regional Location Map - Wawa-Holdsworth Gold

Project is located 25 km NE of Wawa Ontario, Canada, uniquely

positioned proximal Argonaut's >6Moz Au Magino deposit property, and

Richmont's >1Moz Au Island Gold Mine, along an underexplored

extension of the prolific Michipicoten Greenstone Belt. Within a few

km of impressive gold deposits of miners whose deposits keep

growing, and mills. There is road access to the property, it is

close to power, rail, and a stable workforce, in a mining-friendly

region.

------ ------

------ ------ ------

------

------ ------

------

# #

This release may contain forward-looking statements regarding future events that

involve risk and uncertainties. Readers are cautioned that these forward-looking

statements are only predictions and may differ materially from actual events or

results. Readers are cautioned that not until subject companies actually

releases official details themselves should anyone rely on the information

presented herein. Articles, excerpts, commentary and reviews herein are for

information purposes and are not solicitations to buy or sell any of the

securities mentioned.

Contact information:

Fredrick William,

Editor in Chief

Market Equities Research Group

f.william@marketequitiesresearch.com

|