|

|

MGX Minerals

Inc.

Technology,

Industrial, Mining, Energy

CSE: XMG, OTC: MGXMF,

Frankfurt: 1MG

www.mgxminerals.com

|

|

Prices |

Share: C$1.61 |

MCap: ~C$152M |

On: February

15, 2018 |

|

History |

52-Week: C$1.96–C$0.73 |

|

|

|

Prices |

Shares O/S:

~95M |

|

|

MGX

Minerals Inc. is a diversified Canadian resource company with

interests in advanced material and energy assets. MGX is also a

clean technology company focused on accelerating emerging energy

and energy commodity technologies that disrupt the status quo.

The Company is at the initial phase of commercialization with

their Petrolithium technology targeting the extraction of

lithium from oilfield brine and wastewater, and is advancing

innovative regenerative zinc-air flow battery technology that is

immune to the growth of zinc dendrites which have traditionally

plagued zinc-air flow batteries. |

|

Listed below are some of the key business lines

of MGX Minerals, each unique and ripe with potential

catalysts:

1) Petrolithium/Lithium

Brine Technology

- The Oil and Gas sector

discards more lithium than anyone in the world produces,

MGX Minerals has Petrolithium solution.

MGX Minerals proprietary/patented

brine processing technology gives the Company a

significant advantage in the marketplace having solved

the problem of magnesium (Mg) in lithium (Li) laden

brine, able to deal with very complex/dirty brines. Up

until now rich complex Li brine projects with high Mg:Li

ratios have been passed over as technology did not exist to

economically separate the two. MGX's technology

now positions scores of complex lithium brine projects (previously

untouchable) across the globe ripe for production, with better

economics than solar evaporation. MGX Minerals Inc. is also

positioned technology-wise to commercially exploit the mineral rich

brine that is a residual by product of geothermal power generation.

MGX is looking to bring the first 750bpd wastewater brine plant in

Alberta in production this Q1-2018. The Company's first major contract

will be for a contract with a major oil sands company, for a 1,200m3

(7500bpd) per day, $45/m3 revenue agreement. Initially the

commercial operation is expected to represent a modest,

roughly $500,000/year revenue stream, or about $3/b --

costs, however, are less than $1/b (information source:

recent CEO interview). MGX Minerals has

recently

announced improved refinement of its nanofiltration lithium

technology, and has commenced initial design of a 2400 cubic meter

per day (~13,000 barrels) plant.

Petrolithium processing involves

capturing oil, natural gas, and minerals from oil & gas

industry brine, leaving cleaner water behind. MGX

Minerals is deploying the only technology that can deal

with ultra-high total dissolved solids plaguing the oil

& gas industry. The process involves complex floatation

and nano-filtration technologies which use reagent

coated filters each designed to pull a specific element

(NOTE: MGX is not limited to Lithium, it can target a

wide range of elements, including gold and silver if

present). The following excerpt is from the Company's

February 12, 2018 news release entitled 'MGX

Minerals Announces Advancement in Nanofiltration Lithium

Technology; Commences Initial Design of 2400 Cubic Meter

Per Day Plant'; "The System utilizes a highly

charged Replaceable Skin Layer (RSL™) membrane related

to the nanofiltration and High Intensity Froth Flotation

(HiFF) system, known as nanoflotation, which

collectively have demonstrated performance superiority

over other processes typically used to remove

contaminants. The technology allows ultra-high

temperature water treatment (up to 700°C) at 10-30 times

the efficiency of existing ultrafiltration systems and

offers numerous environmental water purification and

mineral extraction benefits, including contaminant

removal, mineral recovery, reduced energy demand, and

small footprint."

This February-2018 the CEO of MGX Minerals provided an

interview update in which he stated "Regarding

the demonstration contracts, 90% is completed, 2 or 3 from 12 are

being followed up at the moment. MGX is looking for projects with

scale. One of the follow up contracts the company is closing in on,

is a 5,000bpd agreement with Chesapeake Oil, which has wastewater

containing 200ppm Li which is very high in wastewater terms. MGX

foresees about $3.4M in LCE revenues, and about $7M in water

treatment revenues, together generating $6.7M in profits. MGX is

still within the demonstration contract on this one, bulk samples

are ongoing, more testing has to be done, could take another 6

months for a decision."

Additionally, this week

The company has commenced lithium brine testing in Chile on multiple

projects, with MGX's brine processing technology standard economic grade brines of

say 500-600mg/L Li are NOT necessary; half of this would provide

interesting/potentially very lucrative outcomes.

|

Video:

MGX's Mass Energy Storage Zinc-Air

Battery Solutions

(2 min.15 sec.)

|

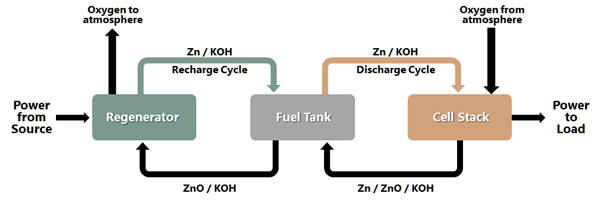

2 )

Mass Energy Storage Zinc-Air Battery

MGX Minerals has positioned

itself as a leader in mass energy storage solutions with tech that

is cost-effective, easily scalable, and eliminates all short-term energy

downtime. MGX is advancing innovative

modular energy storage batteries through

proprietary (100%-owned)

patented zinc-air technology via its wholly owned subsidiary ZincNyx Energy Solutions Inc.

(a private company acquired from the

mining giant Teck Resources in December 2017). Think Tesla's Powerwall and Powerpack but

without lithium, powerful, quick charging, and low cost;

this innovative regenerative zinc-air flow battery

technology is designed for energy storage in the 5 kW to

1 MW range for extended periods of time. The tech allows

for low cost mass storage of energy, and can be deployed

into a wide range of applications, including

utility-scale storage and power grid load stabilization,

long term backup power for industrial, commercial, and

military facilities, remote location off grid and micro

grid applications, and diesel generator replacement or

hybridization.

MGX's innovative regenerative

zinc-air flow battery technology is immune to the growth

of zinc dendrites which have traditionally plagued

zinc-air flow batteries, and the Company has begun

commercial development for the mass production of its

scalable 20kWh capacity zinc-air mass storage battery.

Unlike conventional batteries, which have a fixed

energy/power ratio, MGX’s technology uses a fuel tank

system that offers flexible energy/power ratios and

scalability. The storage capacity is directly tied to

the size of the fuel tank and the quantity of recharged

zinc fuel, making scalability a major advantage of the

flow battery system. In addition, a further major

advantage of the zinc air flow battery is the ability to

charge and discharge simultaneously and at different

maximum charge or discharge rates since each of the

charge and discharge circuits is separate and

independent. Other types of standard and flow batteries

are limited to a maximum charge and discharge by the

total number of cells as there is no separation of the

charge and discharge components.

Fig. 1 (above) Principles of operation

Zinc-Air Battery.

The key difference between the Tesla Powerwall

versus MGX's ZincNyx Fuel Cell Battery is the ZincNyx storage

capacity is much larger; in order to increase storage simply

increase the size of the fuel tank and add more fuel (zinc in this

case). To increase storage of a Tesla battery you have to add both

output and storage capacity. This decoupling of output power and

storage is key and makes the ZincNyx system much cheaper in terms of

storage capacity. So the real question is how much energy can you

store, not just what is the rated output capacity. In terms of size,

the system will be about the same size from 5kW to 20kW, as

everything is shrinking in size in the production design phase at

the moment with the exception of the fuel tank itself. A standard

5kW system will have 40kWh storage, the new 20kW system will have

160kWh storage. The target price, like others in this space, has

been US$250/kWh for an 8 hour backup system. This would result in $10,000

for the 5kW system and $40,000 for the 20kW system. Depending on the

application and configuration, the price can be significantly higher

or lower. The fuel cells, needed for output, are the expensive part

of the battery. With economies of scale, prices would go down.

MGX Minerals is targeting mid-2019 for large

scale manufacturing of its ZincNyx Fuel Cell Battery and already has

manufacturing partners in place.

Recent related news:

3) Industrial Minerals

Project, in Invermere, BC, Canada

The Driftwood Property contains a valuable magnesium

deposit, a significant asset of the Company that is

expected to have a PEA published this Q1-2018 (targeting

the end of February). This project originates from MGX

Minerals early days, before the Company began advancing

next generation energy technologies. The magnesium

deposit is a strategic holding that MGX will look to

have its JV partner advance. We understand MGX Minerals

has employed extensive test milling and is looking at a

capex of ~$100M, with a daily throughput of ~1,100 tpd,

a total production of ~2.7Mt MgO, there will be the

option to mill it on site, or alternately MGX could ship

a 25% concentrate across the border for double revenues

for magnesium metal.

4 )

Numerous Lithium Holdings

MGX Minerals has amassed a

sizeable portfolio of lithium holdings (too numerous to

list here for the sake of brevity).

MGX is the largest holder of Li brine holdings in North America,

it has ~2 million acres under staking options under a variety of

arrangements. Below is a synopsis of two projects of

significance, that are currently being meaningfully

advanced:

|

•

110,000 acre Petrolithium project in the

Paradox Basin of Utah

-- The first large scale integrated

petroleum and lithium exploration project in

the United States. The Project is located

next to the Lisbon Valley oilfield located

within the Paradox Basin, Utah which has

shown historical brine content as high as

730 ppm lithium (Superior Oil 88-21P) and

past production of oil exceeding 50 million

barrels. MGX recently completed 3D seismic

geophysics to outline subsurface geological

formations and structures favorable for

accumulations of oil and gas as well as

lithium brine bearing formations. The survey

included ~9,000 source points. |

|

•

MGX Minerals’ Joint Venture Partner Power

Metals is advancing the Case Lake Lithium

Property

-- encountering exceptional grades /

quality intercepts; ie...

- 1.79% Li 186ppm Ta (Tantalum) Over 6m,

- 2.07 % Li2O and 213.96 ppm Ta Over 18.0

m,

- Samples up to 7.14% Li2O on Surface,

- 26.0 Metres of 1.94% Li2O and 323.75

ppm Ta |

|