|

Market

Equities Research - Market Bulletin

January 3, 2022 1:30 AM UTC

Eyes on DIAGNOS Inc., Multiple Catalysts Converging, Major Players

Positioning

-

The eyes not only allow us to see, they also have something to

say; the blood vessels at the back of the eye (the retina

vasculature) are closely connected to your health and can

indicate underlying problems.

-

Please note the context in terms

of size of entities actively engaged with DIAGNOS to integrate

its technology into their business.

|

Share data, Capitalization, & Corporate info

Shares Outstanding:

~69.12 million

Recently Traded:

~CDN$0.34/share (TSX-V:

ADK)

52 Week High/Low:

$0.77 / 0.33

Current Market Capitalization:

~$24 million CDN

Corporate Website:

www.DIAGNOS.ca |

|

DIAGNOS Inc. (TSX-V: ADK) (OTCQB:

DGNOF) (Frankfurt: 4D4) is a Software as a Service (SaaS)

provider that pioneered 'Computer Assisted Retinal Analysis’ (CARA),

a machine assisted learning technology that detects and classifies

serious medical conditions in patients with diabetes or

cardiovascular issues from an image of the back of the eye; diabetic

retinopathy, hypertension retinopathy, stroke, AMD, glaucoma.

DIAGNOS is now making ground-breaking moves as the clear leader into

high-potential markets.

In-short, DIAGNOS Inc. is just one strong news release away from

ripping above $1/share entering 2022. Below is a sampling of

market insight and happenings currently in development by DIAGNOS

offering major near-term upward share price revaluation potential;

Cardiovascular Market:

DIAGNOS' Stroke Predictor CARA platform application began clinical

trials on Dec. 6, 2021 with CommonSpirit Health Research Institute,

the 2nd largest health service provider in the USA (~137

hospitals and >1,000 clinics, in 21 states). NOTE: As news of

progress materializes on this front, look for shares of TSX-V: ADK

to respond well to reflect the enormous upside potential. Success in

early detection of cardio vascular issues in such a non-invasive

manner for the patient could quickly result in the DIAGNOS CARA

platform being a go-to service in a massive market place that

currently spends over half-a-trillion-$ a year in drugs and services

for cardiovascular and stroke issues.

CONTEXT takeaway: ”the 2nd largest health service provider in

the USA.”

Eyecare & Wellness Markets:

Leveraging DIAGNOS’ proven ability to screen for diabetic

retinopathy and more, eyecare stores appear to now be maturing into

Point of Care wellness diagnostic centers using DIAGNOS’s

technology. Look for related news announcements and deployment

rollouts to accelerate. In fact, Essilor Luxottica (symbol EL on

Euronex – the world’s largest eyecare company with ~18,000

locations) has a

MoU signed with DIAGNOS and is actively in negotiations on three

transaction points; 1) Deployment/access to DIAGNOS’ existing CARA

platform, 2) development of DIAGNOS technology into Essilor’s line

of fundus camera, 3) access to future applications of CARA as they

rollout.

CONTEXT takeaway: “the world’s largest eyecare company with

~18,000 locations.”

Also on this same front look for many other industry participants to

embrace DIAGNOS’ technology. New Look (with 407 locations in Canada)

signed on for CARA platform roll-out recently.

Additionally, DIAGNOS is currently assisting in roll-outs for

numerous medical facilities and government screening programs

globally.

DIAGNOS Inc. appears to possess exceptional risk-reward metrics

for investors establishing a long position now; ADK.V only has

69.12 million shares outstanding, there are very little warrants

left, and insiders & family office own ~40% of the outstanding

shares. DIAGNOS:

● is debt free,

● has money in the bank,

● has an untapped C$2 million government credit line if needed,

● has a high-margin SaaS model (it only costs ~4 cents to process an

image that it charges between ~C$5 - $10),

● is expected to be cash flow positive (based on solid contracts

in-hand) in the coming fiscal year,

● has numerous new business prospects in discussion now, and

● is expected to see rapid revenue growth.

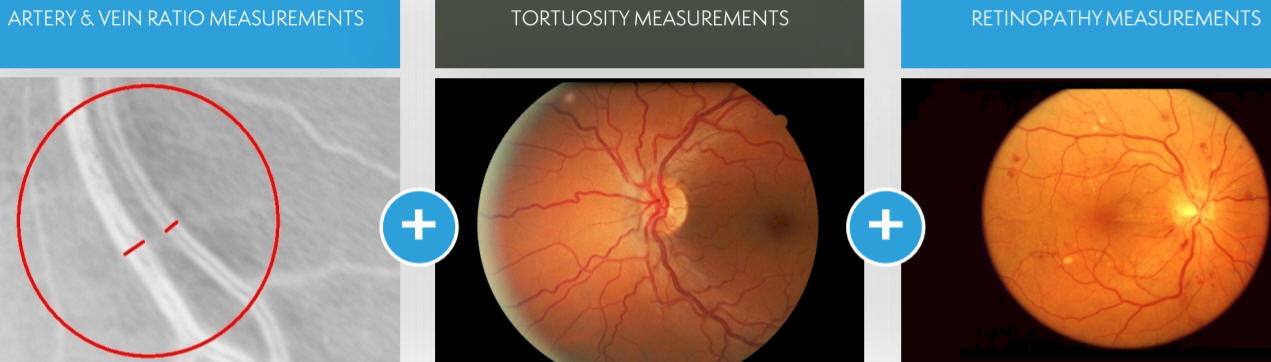

Figure 1. (above) CARA (Computer Assisted

Retinal Analysis) Artery Vein (AV) Ratio analysis in action and retinal images

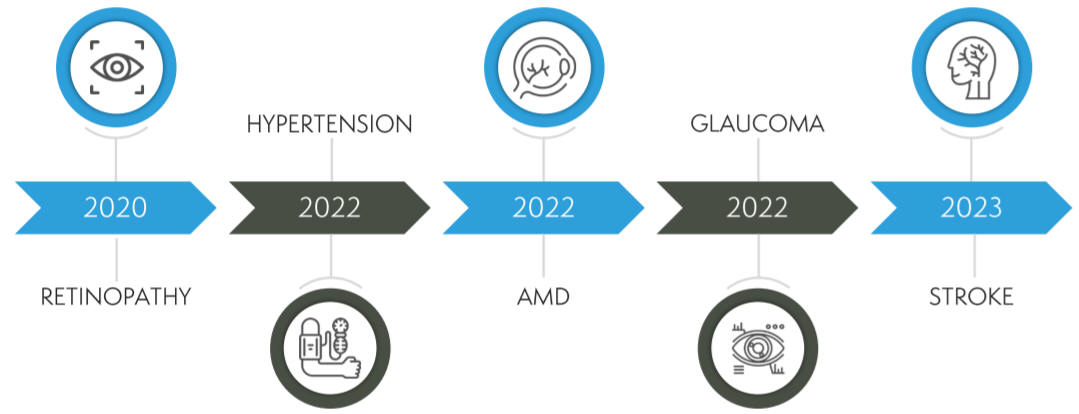

Figure 2. (Above) Revenue

generating medical applications - Product

pipeline.

DIAGNOS

Inc. received its first institutional coverage from the independent

investment bank / advisory / equity research firm Echelon Capital

Markets, its current rating is 'Top Pick', 'Speculative BUY' with a

near-term (12 month) target price per common share of DIAGNOS of

$1.55 Canadian (or in US dollars: USD$1.23 or in Euros: €1.09)

--

click here

to view full copy of their latest report. The original initiating

report was exceptionally thorough (~40 pages), the analyst contacted

multiple industry participants, and recently (November-2021) sat

down for an

interview

[running time 32 min. Youtube] on his reasoning for making it a top

pick entering 2022. Note, the analyst share price target is based on

the DIAGNOS’ CARA Platform that is currently in use and does not

include progress on the Stroke Predictor application that is the

subject of clinical trial news – needless

to say a much higher share price target is justified if success in

the Stroke Predictor clinical trial is demonstrated.

The following

URLs have been identified for further DD on DIAGNOS Inc.:

Company website:

http://www.diagnos.ca

SEDAR:

https://sedar.com/DisplayProfile.do?lang=EN&issuerType=03&issuerNo=00003037

Insider activity:

https://www.canadianinsider.com/node/7?menu_tickersearch=ADK+%7C+Diagnos

Recent Technology Journal Review:

https://technologymarketwatch.com/adk.htm

# #

This bulletin may contain

forward-looking statements regarding future events that involve risk and

uncertainties. Readers are cautioned that these forward-looking statements are

only predictions and may differ materially from actual events or results.

Articles, excerpts, commentary and reviews herein are for information purposes

and are not solicitations to buy or sell any of the securities mentioned.

Contact information:

Fredrick William, BaEc.

Market Equities Research Group

f.william@marketequitiesresearch.com

|