|

Market

Equities Research - Market Bulletin

August 12, 2021 1:00 AM UTC

World’s 10 biggest gold mining companies based on 2020 production,

and review of Jr. mining explorer Lucky Minerals Inc.

Figure 1. (above):

Producer pouring gold bars.

The following is a

list of the top gold miners in the world based on their 2020

production:

1. Newmont HQ in United States

NYSE:NEM 5.88 moz (-3.45%)

2. Barrick Gold HQ in

Canada TSX:ABX 4.84 moz (-3.39%)

3. Polyus HQ in Russia

RTC:PLZL 2.87 moz (-2.71%)

4. AngloGold Ashanti*** HQ in

South Africa JSE:ANG 2.81 moz

(-14.33%)

5. Kinross Gold HQ in

Canada TSX:K 2.38 moz (-5.93%)

6. Gold Fields HQ in

South Africa JSE:GFI 2.13 moz (+4.41%)

7. Newcrest Mining HQ in

Australia ASX:NCM 2.06 moz (-11.59%)

8. Agnico Eagle HQ in

Canada TSX:AEM 1.73 moz (-2.81%)

9. Polymetal International HQ in

Russia LSE:POLY 1.40 moz (+6.87)

10. Harmony Gold HQ in

South Africa JSE:HAR 2.38 moz (0.00%)

* Does not include equity ownership of other producers.

** Ranking excludes Uzbek state-owned enterprise Navoi Mining &

Metallurgy Combinat, owner of one of the world’s largest gold mines

in Muruntau, as the reliability of its information is unconfirmed

(reports have it having produced ~2 million ounces of gold in 2020).

*** Reported production from continued AGA operations; production

figures were adjusted to reflect a company’s ownership % as of

December 31, 2020 (i.e. AngloGold sold some assets to Harmony in

October).

In total, thirteen companies saw their production

surpass the one million ounce mark; Canada’s Kirkland Lake Gold

(1.37moz), Australia’s Northern Star Resources (1.01moz) and the

UK-based Nord Gold (1.01moz). Sibanye-Stillwater almost made the

list with 0.98moz of gold.

Comment on Global Production of Gold:

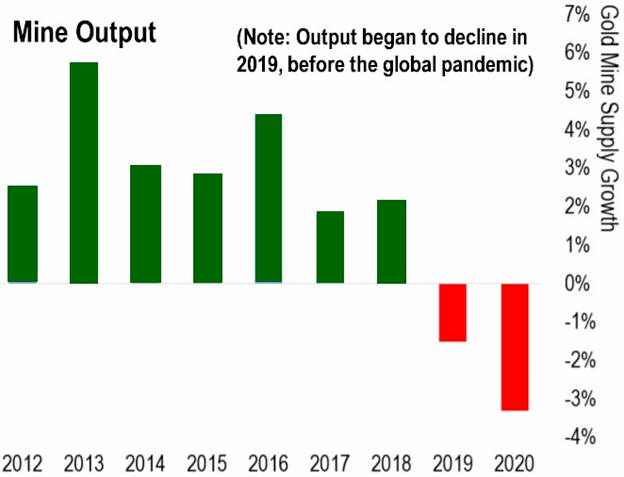

Chart 1. (left) -- Mine Output

Chart 1. (left) -- Mine Output

In 2020, mining

output fell by nearly-4%, which was the biggest drop in over a

decade. Most of this decline was due to COVID-related shutdowns.

------ ------

------ ------ ------ ------ ------ ------ ------

Junior Mining

Explorer Lucky Minerals Inc.

(TSX-V: LKY) (OTC: LKMNF) Presents Opportunity

Lucky Minerals New Gold Discoveries

in Ecuador have Enormous Potential, Now Tracking Multiple Feeder

Zones at Surface

Lucky Minerals Inc. (TSX-V: LKY) (US

Listing: LKMNF) (Frankfurt: LKY)

has several new gold discoveries at its 100%-owned

royalty-free 550km2 (55,000 Ha, or 136,000 Acres) Fortuna Project in

Ecuador, located in prolific mineral belts ~40km from Lundin Gold's

Fruta del Norte (9.48 M oz Au I+Inf) deposit and the Mirador (2.7 M

oz Au and 5.9 B lbs Cu M+I) deposit. Within the last few months

Lucky's geological team has discovered an entirely new gold trend,

the Shincata Gold Trend, which extends across the NW Fortuna

concessions for ~22 km, in an area of multiple volcanic centers.

Lucky's geological team is actively exploring on ground with all the

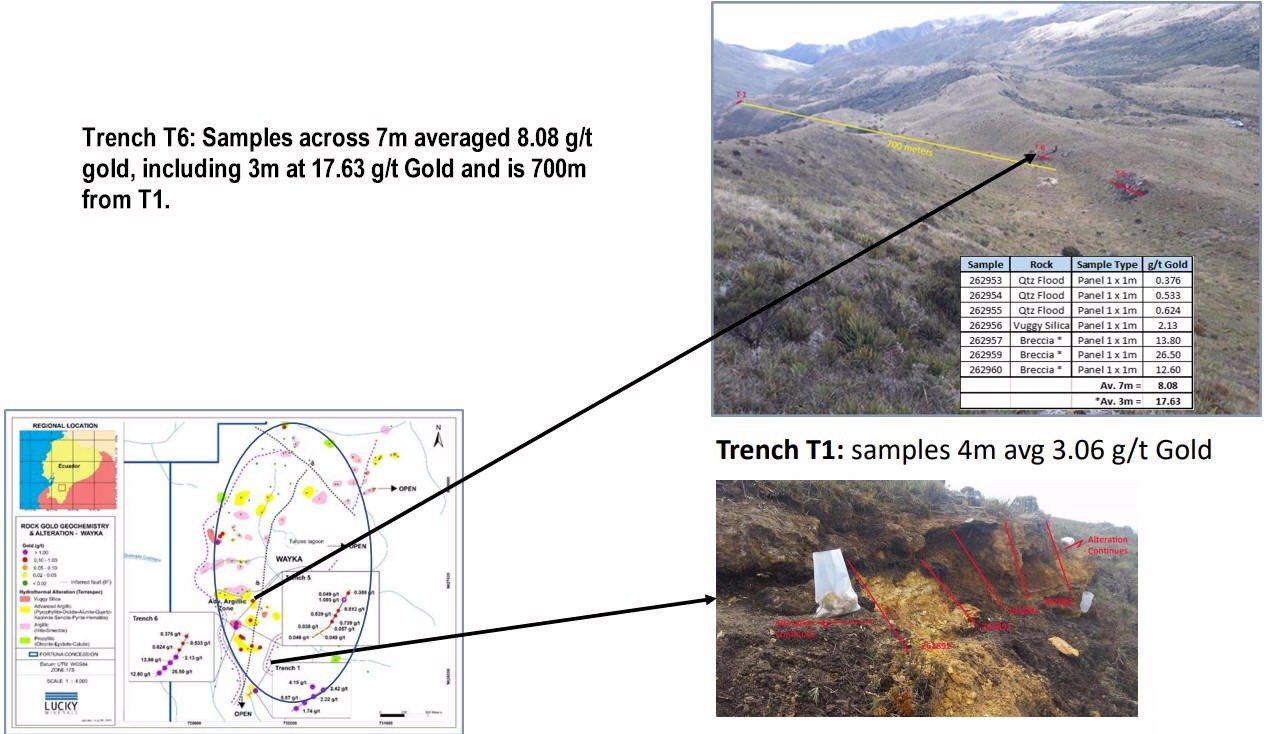

ingredients for extensive gold potential; on July 12, 2021 announced "Lucky

Minerals Systematic Sampling of Outcrop Averages 3.06 g/T Gold over

4.0 m at Wayka" (T1 results), and July 30, 2021 "Lucky

Minerals Samples 8.08 g/t Gold Across 7.0 m Including 17.63 g/T Gold

Across 3.0 m at Wayka" (T6 results) -- In-short, Lucky Minerals has tapped into a

high-sulfidation epithermal gold system that has shown economic levels of mineralization at surface, this type

of deposit tends to be a disseminated body that can scale up quickly.

The geological team is tracking multiple feeder zones at surface

(T1 & T6 are 700m apart), how far

this carries is being investigated now; there are teams in the field

bringing back new information from material exposed at surface. The

geological team is mapping advanced argillic alteration

(high-temperature

volcanic material favourable for trapping/hosting gold) across a

significant and rapidly expanding footprint, there is evidence pointing

to parallel feeder zones to be uncovered, and Lucky plans to put

drills into optimized targets this year -- favourable results are apt

to send the share price vertical. The aforementioned July 12 feeder

zone has been followed to at least ~30 m, it trends east to west,

with stellar grades in what has been released to date. This is a rapidly developing story, lots of

information is incoming, and quickly turning into one of the most

exciting exploration efforts in the mining sector.

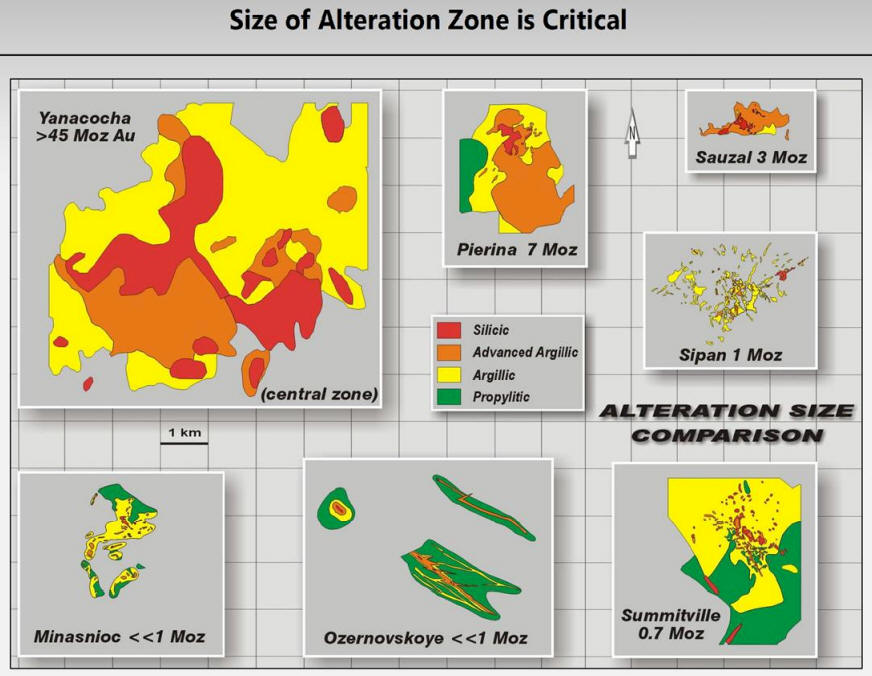

Lucky Minerals is on to a potential

world-class discovery at its Wayka Gold Discovery Zone

-

Wayka is a high sulphidation

epithermal gold system (examples of such deposits

that are world-class: Yanacocha, Pierina, Pueblo

Viejo).

-

Trenching has confirmed a large

system is mineralized with gold between trenches T1

and T6 (700m apart).

-

High temperature alteration

footprint (advanced argilic – blue elipse on map

below) more than 1.5 km by 1.0 km and still open in

three directions. It is generally the area where

most gold mineralization is localized in these type

deposits.

Figure 2. (above) -- Trench T6: Samples

across 7m averaged 8.08 g/t gold, including 3m at 17.63 g/t Gold and

is 700m from T1.

Figure 3. (above) -- Size Matters,

Alteration Size Comparison of some world class high sulphidation

epithermal gold systems. Considering Lucky has a high

temperature alteration footprint more than 1.5 km by 1.0 km and

still open in three directions, excitement runs high as the Company

plans a maiden drill program.

The Fortuna Gold Project lays within a tertiary

volcanic belt that trends NE-SW through the property, these are

volcanics which are known to hosts major epithermal gold deposits,

similar trending structures intersect neighboring Fruta del Notre,

Mirador, Loma Larga, El Mozo and others. Satellite imagery confirms

what is understood to be a collapsed caldera proximal to the

discoveries Lucky is now making.

For further DD

on Lucky Minerals Inc. see the following URLs:

Corporate

website:

https://www.luckyminerals.com

Recent

Mining MarketWatch Journal Review:https://miningmarketwatch.net/lky.htm

# #

This bulletin may contain

forward-looking statements regarding future events that involve risk and

uncertainties. Readers are cautioned that these forward-looking statements are

only predictions and may differ materially from actual events or results.

Articles, excerpts, commentary and reviews herein are for information purposes

and are not solicitations to buy or sell any of the securities mentioned.

Contact information:

Simon Levinson

Market Equities Research Group

s.levinson@marketequitiesresearch.com

|